The Coronavirus Job Retention Scheme

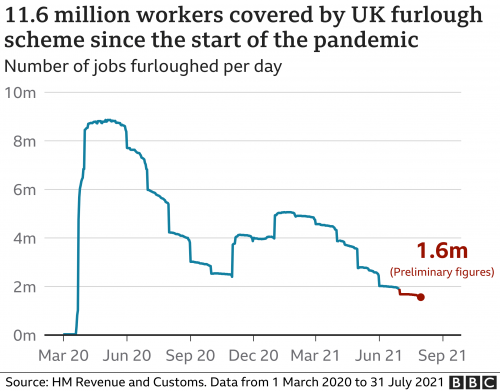

The Coronavirus Job Retention Scheme, commonly referred to as furlough, was introduced by the government in March 2020. It aimed to help keep businesses afloat and mitigate the detrimental effects of the pandemic and lockdown regulations on employers and employees. During the height of the pandemic, nearly 9 million people were placed on the government furlough scheme, which paid 80% of employees’ wages up to £2500 per month.

As lockdown regulations have changed and eventually ended as of July 19th, the furlough scheme has been adapted and extended. As the government worked to phase out the scheme, companies were required to cover a portion of employees’ wages as the government reduced contributions.

The Coronavirus Job Retention Scheme is set to end Thursday 30th September, with the government no longer covering the salary of furloughed workers. Whilst many companies have been working to prepare for this change, some may need to restructure their practice, unfortunately resulting in redundancies. With about 1.9 million workers remaining on furlough, large numbers of workers may face redundancy in the coming months.

Redundancy Process

Redundancy is dismissal based on a lack of company need for the role, rather than due to employee performance quality or conduct. Because of this, redundancy may provide employees with rights to pay, notice periods and consultations.

Whilst furloughed, employees retain their employments law rights, but being placed on furlough does not protect employees from being made redundant. Despite the job retention scheme having success in preventing large numbers of redundancies during the pandemic, as this comes to an end, some companies may need to make structural changes.

Notice of Redundancy

All employees must be given notice of their redundancy by the company, some employment contracts allow for more than the statutory minimum. The statutory notice periods are:

- One week notice: employed under 2 years.

- One week per each year worked: employed between 2-12 years.

- Twelve week’s notice: employed 12 years or more.

Employees can be made redundant with no notice if there is a ‘payment in lieu of notice’ clause contained in their contract. This enables employers to offer payment for the period they would have worked during their notice period. These payments must have tax and national insurance deducted. This can still be offered by employers if not in your employment contract.

Redundancy Pay

You may be entitled to redundancy pay if you have been contracted by your current employer for 2 or more years. The standard redundancy pay is:

- Half a week pay, for every year worked under the age of 22.

- One week pay for each full year worked aged between 22-41.

- One and a half weeks pay for every year worked over the age of 41 (capped at 20 years).

Your weekly pay is the average earned weekly over the 12 weeks before receiving redundancy notice. If made redundant on the Coronavirus job retention scheme, your average will be calculated based on what you would have earned normally, not based on the reduced furlough amount.

Currently, the maximum weekly statutory pay is £16,320 with weekly pay being capped at £544, however, employers can choose to pay more than the statutory amount, this may be to encourage voluntary redundancy or laid out in employment contracts. Redundant employees are entitled to a written statement setting out their total redundancy pay and how this was calculated.

Redundancy pay should be paid no later than the employee’s final payday date, although a later date is acceptable if agreed by both parties. Employees should be notified of how and when they will receive this payment. If not paid on time, employees can make a claim with the employment tribunal within 3 months of their employment ending. If companies cannot afford redundancy, financial help is available through the Redundancy Payments Service (RPS)

Consultation

All employees are entitled to a consultation with their employer to discuss why they are being made redundant and any alternatives to redundancy. Companies should use this time to explain the reasons for redundancy, the number of employees affected, how the redundancies will be carries out and how redundancy payments will be handled.

If less than 19 redundancies are made at the same time, there are no rules as to how the consultation should be carried out, although claims can be made to the employment tribunal if consultation is done improperly or not at all.

If over 20 redundancies are being made by the company at the same time, collective redundancy rules apply. This involves an elected employee representative or trade union representative, who can discuss reasons for redundancy and ways to avoid redundancies. The Redundancy Payments Service (RPS) must be notified before consultations beginning, through an HR1 form, deadlines vary based on redundancy numbers.

Suitable Alternative Employment

Employers can offer alternative employment within the company or associated companies. The suitability of the employment is based on the similarity of the job, the contractual terms, pay, position, location and the employee’s skills and abilities. If suitable alternative employment is available but not offered by the company, employees can make a claim with the employment tribunal for unfair dismissal.

Offers for alternative roles must be offered before their current role ends, to begin within 4 weeks of the end date, they should be made in writing explaining how the role differs from their current role.

If the company offers suitable employment and this is unreasonably rejected, you may lose your right to statutory redundancy pay. If the job offered is believed to be unsuitable, claims can be made to the employment tribunal, which if successful would allow them to receive redundancy pay. Potential reasons could include lower pay, health difficulties or a change in location.

.